Metrics are the heartbeat, blood pressure and temperature of your company: the core indicators that reveal the health of your SaaS business at its most fundamental level. (This is the reason they form a crucial part of many investors’ due diligence).

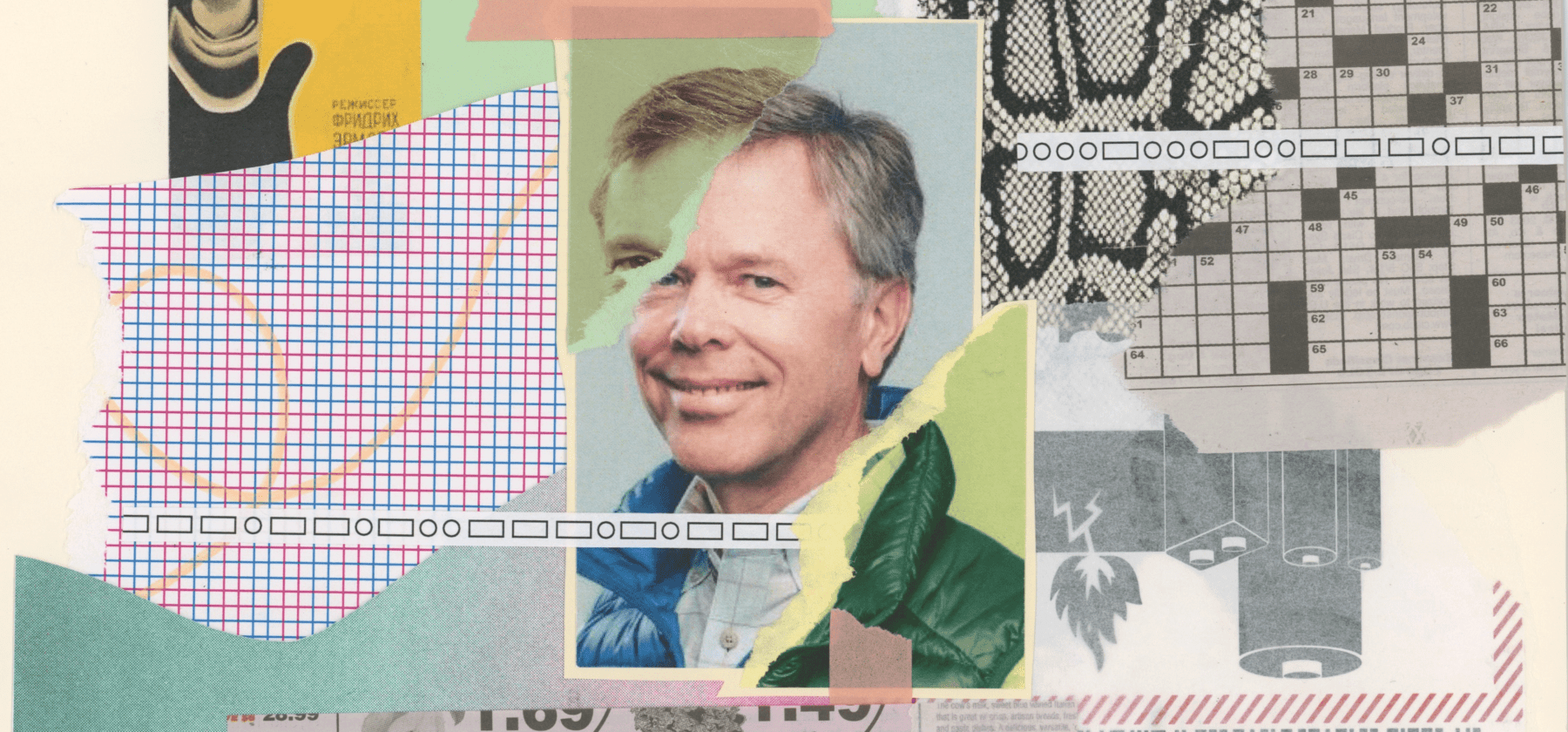

Nobody knows this better than David Skok, a serial entrepreneur turned VC at Matrix Partners. David started his first company in 1977 at age 22, and since then has started four separate companies, three of which went public. As a founder and nowadays as an investor, he is the leading authority on SaaS metrics in the industry, breaking down the complexity of the SaaS business model in a straightforward, no-BS way.

David recently joined me at the SaaStock conference in Dublin to record a very special live podcast, where we talked about everything from the importance of metrics to earning the right to sell. Short on time? Here are five quick takeaways:

- Pricing can be a puzzle. But in those early days, you want as many customers as possible, not the optimal amount of money from every customer. It’s easy to start moving that price upwards when you have the clarity that you’re truly providing value to your customer.

- David looks for two things when picking a winning investment: first, a clear sign of product-market fit in the form of genuinely happy customers who are actually using the products. Second, has the company built a repeatable, scalable and profitable growth process?

- Treat the customer like a bank account: make a deposit before you make a withdrawal. Give them something of value up front instead of asking them for something. You have to earn the right to sell.

- There are three phases in a startup’s lifecycle: finding the right product-market fit, creating a repeatable sales model and scaling the business.

- AI is all the rage in sales, but working hand-in-hand with people is where it will truly shine: identifying who to talk to, what to talk to them about, and getting specific about the right conversations for humans to have together.

If you enjoy the conversation, check out more episodes of our podcast. You can subscribe on iTunes, stream on Spotify or grab the RSS feed in your player of choice. What follows is a lightly edited transcript of the conversation.

John: David, welcome to Inside Intercom. Since it’s your debut on our podcast, could you tell us a little bit about your background and career to date, and your current role at Matrix?

David: Certainly. I graduated from university with a computer science degree, accidentally got into writing myself a software program to solve a problem and started my first company by accident as a result of that. I did a total of five startups. Two of them were backed by Matrix Partners, which is a venture capital firm that I have a lot of respect for. Having done five startups, I kind of felt like I was ready to move into another phase where I was helping people do their startups as opposed to doing another one myself. Venture capital is a great place to go, so I joined Matrix. I’ve been investing in SaaS, and two of my better-known investments might be Zendesk and HubSpot.

John: So you were kind of an accidental entrepreneur at the beginning?

David: Yes. It was in the days when there was no entrepreneurial ecosystem or anything like that at all.

John: What was your first exposure to SaaS?

David: All my life I’d been doing B2B software sales, and as soon as SaaS came out, it was really apparent to me that this was a big breakthrough, both in the way to get at small and medium-sized businesses that had previously been unable to buy technology because they didn’t have IT departments. Secondly, even in selling to the enterprise it was an unbelievable breakthrough because you didn’t have to have the IT department involved to get the approval. You could simply have somebody testing the product over the internet without having a long, complex server install and all sorts of difficult processes there. So I was all over it in a very big way, right in the early days.

John: Presumably the infrastructure has improved a lot since then? I imagine in the early days the theory was maybe ahead of the reality.

David: That’s right. I think Salesforce was one of the very early players, and their infrastructure really wasn’t ready in those days. I think 2008 was really the very beginning of the big wave that happened.

The importance of metrics

John: Why is it that metrics are so important for SaaS businesses?

David: There are a few reasons. The first one is that most of time, investors have looked at something very straightforward in the form of metrics to evaluate a company. And there is a gap: financial accounting metrics. It turns out that those financial metrics just don’t work at all for a recurring revenue business, so I felt there was an essential need for something to be rewritten around that topic – especially internally – because every time I went to my partners when we were losing money at HubSpot despite growing quickly, I had to explain to them that it was actually a good thing and not a bad thing. And they were having epileptic fits about it.

The second reason is that this is actually one of the best business models I’ve seen, where an understanding of metrics can have a huge impact on how well you run the business, because it’s super sensitive to small changes on various different items like how well you upsell your current customer base, what your churn rates are, etc. And that can have a gigantic impact on whether you’re going to be a successful business or not.

The last thing I’ll say about metrics is that they’re a spectacular way to get alignment in a company and drive the entire team towards a common goal. And so if you understand what the right metrics are, they can be an incredible tool for an executive CEO to create the alignment, and to get the company to focus on achieving something. ‘Cause as soon as you start publishing a particular set of metrics, automatically people start working to improve those.

John: Is there one metric you see a lot of SaaS businesses overlook that they should really pay attention to?

David: It isn’t quite as simple as you would like me to make it. I would say it’s somewhat stage-specific, and one thing I fear a little bit is that my early writings on CAC and LTV got too many people to focus on that too early. That’s the wrong time to focus on it, when you don’t have a really fully repeatable and scalable model. But to me, probably one of the most important things any SaaS entrepreneur can do is achieve negative churn in order to have a long-term successful SaaS business. And that means that you’re able to get more expansion revenue from the customers who stay with you than you lose from the customers who churn.

It requires you to have a very flexible pricing scheme: when somebody starts with you, they can start small, but you have additional modules to sell them on. As they grow, you are able to upsell them into additional things. Sometimes that’s a variable pricing axis (like the number of people using the product). In the case of HubSpot, the usage would be tracked by how many leads you had in the system. Sometimes it’s other modules. But you do need to think carefully about product packaging and pricing to enable you to get negative churn. And I think that was an interesting lesson that we had to learn at HubSpot, where we had initially one product and one price point and nothing else.

John: Well, I think that was quite a common approach. At Intercom we said, “Let’s charge $50, because we want to see if people will pay for this.” People spend a huge amount of time agonizing over pricing in the SaaS world – do you think at an early stage you’re better off figuring out whether people want to pay for it at all?

David: That’s exactly what I meant by it being very stage-specific. Right now, I’m spending a lot of time trying to break the journey for an entrepreneur down into nine steps. One of the crucial things I tell people is, “Don’t worry about pricing until you’ve clearly shown you have a repeatable and scalable process.” Because it’s a total waste of time. It’s the wrong thing to be optimizing, and as you say, the first thing to optimize is simply whether you can sell this thing. In those early days, you want as many customers as possible, not the optimal amount of money from every customer. That’s a later metric to focus on, as opposed to an earlier one.

John: I presume the temptation there is to charge a very lowball price, which probably isn’t a great idea either.

David: Yeah, but to be honest, in the very early days, I don’t mind if companies charge a lowball price so long as they can show that they can get a high velocity going. It’s relatively easy to start moving that price upwards as soon as you’ve gotten the clarity that you’re truly providing value to your customer.

Don’t worry about pricing until you’ve clearly shown you have a repeatable and scalable process.

How to pick a winning investment

John: You mentioned a couple of your very successful investments: Zendesk and HubSpot. What are the leading indicators you look for in early stage investments?

David: I’m looking for two things. The first is a clear sign of product-market fit. To me, that means you have genuinely happy customers, who are actually using the products. I will look at metrics that are often not provided to me in the investment deck: I want to actually look at every customer who’s ever bought this product and understand what their usage patterns were over time. Then I want to track what’s happening in terms of churn rates by cohort, not just a general high-level metric on that.

Once I move past product-market fit, the number one thing I’m looking for is whether they’ve built a repeatable and scalable growth process, and is that growth process keeping the customers happy, and is it actually profitable? The way I look at that is pretty simple: are bookings growing consistently? We should let’s define “bookings”, because it’s actually a dangerous term in the SaaS world. “Bookings” is net new ARR that’s added. I will look at the quarterly net new ARR number, and I want to see that number increasing quarter after quarter after quarter consistently. It’s very easy to say on the microphone here today, but it’s really hard to do in practice. In order to pull that off, you have to have cracked leads that are harder to find. Secondly, it has to show you actually understand how to onboard new salespeople and consistently make them more productive as they join. We often don’t see people who are anywhere near as good as I’m actually saying, but I’m looking for how far along they are on that journey. Do they understand what that journey looks like? Do they show they have strong evidence of getting there?

John: In terms of HubSpot, what was it that sealed the deal for you?

David: Great founders are a key part of one of the things that we look for. They were really an outstanding pair of people who meshed very well together. It turns out the product was actually terrible in the early days, and it was one of the things we had to fix later on. But they had cracked something important, which is they had created a movement. They understood that inbound marketing – this new way of selling – was really powerful, and they had created a movement around that. We saw that this movement was powerful, and that they would get enough time to fix the product. The interesting thing about HubSpot was that they didn’t actually have a product person in the team in the early days. We didn’t realize that until we were in the investment, and so we then went to work very hard on trying to help them fix and understand what that person looked like, and we helped them solve it.

John: So you’re saying you don’t necessarily have to be a product first company to succeed. You can be really strong at marketing or some other aspect of the business.

David: That’s dead right. In fact, one of the big arguments I have with one of my partners is, “Which is better: to be product first or very strong on sales and marketing?”

Earn the right to sell

John: In your opinion, what’s the best way to onboard a sales team?

David: I’m passionate about funnels. I’ve been studying funnels for years and years. With my first startup, I was stuck with a 9-month sales cycle selling CAD systems to architects. I was very frustrated by this, so I spent a lot of time thinking about it and came up with an idea – which was to take all the money we made on the maintenance over the last seven years and make a huge bet on a one-day event. Halfway through the day, the first customer came up and said, “Can I place an order?” I hadn’t anticipated this would happen, so I got my assistant to run down and type out an order form, which the customer filled in by hand.

My advice to entrepreneurs is to treat the customer like a bank account: make a deposit before you make a withdrawal.

By the end of that day, we’d done $4 million in business, which was much as we’d done in the prior 12 months. We took a 9-month sales cycle and busted it down to one day. You have to get inside your buyer’s head and really understand their emotional reactions to the thing you’re trying to sell – and the process you’re trying to use to sell – and you have to use that insight about how they think to really unlock great breakthroughs.

John: And that probably means getting out of the office, talking to customers, and looking them in the eye.

David: Yes. This was always just a natural thing for me, but I see that it’s not that natural in most companies. You want somebody who intentionally does all their thinking from the customer’s standpoint. How are they going to react to you asking for their email address on your website? How are they going to react to this free trial you want them to do? How are they going to react to being asked to come to this event?

John: And of course, all that’s changing because forms used to be a big thing on websites, but now it’s all about getting people to interact with you through chat.

David: Well, that was actually a great redesign, because those forms were an annoyance to the customer. Every time you wanted to get a little piece of content, you’d have to deal with this this damned annoying thing that asked you for your email address. Nobody wants to give their email address away, so if you’re in the buyer’s mind you’ll understand that’s a bad thing to ask for. My advice to entrepreneurs is to treat the customer like a bank account: make a deposit before you make a withdrawal. Give them something of value up front instead of asking them for something. That will work much better for you; you have to earn the right to sell to them.

The benefits of sharing knowledge

John: You write an incredible blog for entrepreneurs. When did you start writing and why?

David: When I started, it was not at all clear that it would have any kind of a benefit for me as a VC. I just really love educating and helping people. It’s a very core fundamental thing about what drives me and gives me satisfaction in life. I started the blog mostly because HubSpot was telling me that blogging was the future, and I figured that if I was going to be an investor in the company, I’d better understand what the hell they were talking about. I had no clue it would be remotely interesting to anybody. But I realized it was valuable to people, and I got pleasure out of helping them. So I continued to write for that reason.

John: You were one of the first people to write about things like LTV and CAC. Do you feel that’s become almost too popular at this stage?

David: Recently I wrote about the right time to think about LTV and CAC, because if you don’t have a repeatable process and you’re not generating leads using paid sources, you’re not going to be on the stage where it’s all organic, and you’re not really ready to understand what your CAC is or what your LTV is. I do think it’s helpful to have an awareness of LTV and CAC and to understand, for example, that if they’re using an insight sales organization, they’re going to have a CAC that’s roughly in the range of $500 to maybe $10,000 per customer. They can understand that if they don’t price this thing at $1,000 or so, they’re not going to be able to make money. When you’re too early, that’s a mistake. And I kind of regret the fact that I put it out there without a caveat.

Sales used to be an art form. Now it’s both a science and an art.

The other thing I see occasionally that’s a flaw that I probably helped to create was an obsession with accuracy in metrics. So what is the power of metrics? Metrics can really help you make smarter decisions. And it turns out with CAC and LTV, one of the most powerful decisions it can help you understand is which customer segments are most profitable and which segments are not. You can then do one of two things there: you can focus all your marketing energy on getting to the right segment (and you may cut out the segment that’s not that profitable). Or you could decide to analyze the segment that was not profitable.

Let’s take HubSpot in this particular case. They were selling to VSBs (very small businesses), and it was highly unprofitable. They had a 1.5 LTV to CAC ratio. But they found something interesting by doing that analysis, which was their partner channel had a really good 6-to-1 LTV to CAC ratio. And the cool thing was that the partners were actually selling to the VSBs. So they cut out selling to the VSBs, tripled down on the channel partners and used the channel partners to sell to the VSBs. So that was a case where LTV to CAC is super helpful in providing these insights about how to change and run your business differently.

John: And that agency model has been hugely successful for HubSpot, so it’s really interesting that’s where it came from.

David: That’s where it came from. And again, ultimate levels of accuracy are not the crucial things here. The question is whether you can enough accuracy that you’re able to understand your business well enough to get these insights and drive the business correctly.

The three phases of a startup’s lifecycle

John: You’ve described a startup’s life cycle as being split into three phases. Can you give us more detail on the distinct characteristics of each of them?

David: The origin here is that Eric Ries published his terrific book The Lean Startup, and it focused on the first phase, which is the search for a product-market fit process. And you had the impression (if you read the book) that as soon as you found product-market fit, you were ready to scale. It turns out that’s actually true for B2C businesses, but not true for B2B businesses at all. There was a missing phase nobody had written about. And I call that the search for repeatable, scalable and profitable growth process. It’s a phase I’m really focused on trying to document and help entrepreneurs understand what’s involved in that.

I’ve actually busted that down into five sub-phases, and it starts with the founder being able to figure out how to sell the product. Then, the founder has to be able to figure out how to take a non-founder and get them to sell the product. Once they have a non-founder successfully selling it, they need to create a scalable unit see if their lead source scales. If that works, I’ve found that things typically break on a customer success standpoint as soon as you start scaling. So you have to revisit customer success. Sometimes that means not selling to certain customer segments because they’re actually not happy with your product, and they’re not the right fit for it.

John: So it goes back to the work that HubSpot were doing when they analyzed their segments that weren’t profitable?

David: Exactly. Then, the last piece of it is figuring out how to make it all profitable. Often, that means looking at the gross margins, which you shouldn’t pay attention to too early. I figured out a lot of people try to skip the stages and rush things by hiring a ton of salespeople before they’ve got a repeatable sales motion. That’s a huge mistake. It’s really crucial to understand where you are, to execute the step you’re in and to finish that step before you jump to the next step. Otherwise, you’ll end up burning a ton of cash and having to go backwards to finish that step off.

John: It’s probably not the glamorous work, compared to the early stage. Founders love working on product. Scaling up is kind of glamorous, but there’s this really important stage in the middle that you’ve got to get right, which is probably poring over spreadsheets most of the time.

David: It is, and it’s an awful lot of execution. I often think that vision is about one-tenth, and execution is nine-tenths. Finding great people who are really strong at execution is very crucial at that stage. You want what I call a pathfinder-trailblazer type of person. The typical salesperson is used to working from a playbook. But in the early days, you don’t have a playbook. The whole idea of this phase is to actually design that playbook and come up with it. So before you have it, you need a pathfinder-trailblazer type of person, who’s actually good at figuring out who you’re going to sell to, what messages to use, what price points to use and what kinds of product features are essential to develop. All of those things have to be figured out. And that early stage of figuring out, that’s a special talent. But that talent will not work in normal, regular selling environments. So you have to try and figure out how to keep them in the company and use them again when you’ve got a new product introduction.

Vision is about one-tenth, and execution is nine-tenths.

When to invest in sales ops

John: And I think one of the things we’ve been looking at a lot recently is the whole area of sales ops. I think it’s a very interesting function, but a lot of startups probably don’t invest in it early enough. When is the best time?

David: I believe in a SaaS business, sales ops is a very valuable function that should be hired pretty early on – at the stage when you might have as few as three or four salespeople. The reason is that sales ops can have a huge role in two things. One of them is codifying what you’re learning by creating and documenting this playbook in such a way that when you hire a new salesperson, they can be immediately trained and get up to speed far more quickly. Investing in a new salesperson is an incredibly high expense to the company, and a lot of companies just do a very poor job of that onboarding experience. So I see sales ops as being great in that area. The other thing is that they’re outstanding at figuring out the metrics of what’s actually going on and using those metrics to drive different behaviors and decisions.

John: It’s very different to the salesperson even of 10 years ago, isn’t it?

David: Oh, yeah. We’re talking about a world where sales used to be an art form. Now it’s both a science and an art. And the sales ops person is the person who really gets the science part of it and is using the data to help drive the important decisions. There are huge insights to be found in that data in today’s world.

John: How do you see that relationship between automation and salespeople playing out in the near term?

David: We’re still in the very early stages, but over time it’s going to have a very big impact, particularly because the customer has a great deal of joy in finding a way to go through the sales process without having to have a salesperson involved. A very good place for a bot is in the early stages before the customer has clearly decided to buy something. If you can get the bot to help them, it’s a much more comfortable interaction for the customer. Then, that can seamlessly migrate over into a human, and it feels a more natural progression for the human to jump in if the bot failed to answer the question properly for them.

So I think AI will be really helpful at identifying who to talk to, what to talk to them about and suggesting the best conversations to have with specific people. It’ll get great at helping us automate certain things like customer success questions that are just somebody asking the same question over and over again. But I think it’s important to say that ultimately, humans are still really crucial. I don’t see the sales role going away, I see it being augmented in very nice ways by AI.

John: David, it’s been great having you on the show. Thanks for taking the time to come and talk to us after your talk here at SaaStock.

David: It’s a real pleasure, John. Thank you very much for the time.