In many respects, it’s now almost impossible to envisage a work environment that doesn’t rely on a SaaS product in some shape or form. But this supercharged evolution has meant that the world of SaaS is forever transforming at a breakneck pace.

Over this same period, one tech company has emerged to become similarly entrenched in the everyday life of people around the globe. Google. Unarguably one of the biggest brands in the world today. What can we, in the SaaS sector, learn from one of tech’s true behemoths? On this week’s episode of Scale, Matt Rogers, Head of SaaS Initiative at Google, is here to enlighten us.

Over the course of his conversation with Amanda Connolly, Matt covers the challenges faced by SaaS companies both starting out and scaling in today’s swiftly evolving market. He brings the necessary context to companies hoping to make sense of how to operate in a forever shifting environment. They also turn their attention to AI trends in SaaS, and Matt offers his opinion on who’s doing it right and what advancements can we look forward to in that space in the next few years.

Listen to the full episode above or check out Matt’s takeaways below.

This is Season Two of Scale, Intercom’s podcast series on moving from startup to scale-up. If you enjoy the conversation and don’t want to miss the rest of the series, just hit subscribe on iTunes, stream on Spotify, Stitcher, or grab the RSS feed in your player of choice.

1. Building successful SaaS companies in a rapidly evolving market

New SaaS companies spend the majority of their time trying to determine three things: how they’ll develop a great product, how to show customers it’s relevant to their needs, and how to get to market.

They often struggle, however, to define their mission (beyond simply making money). Many young startups overlook this step entirely, while others water down their mission statement into something they can’t possibly act upon at scale. But as Paul Adams (Intercom’s own SVP of Product) explains, distilling an actionable mission is absolutely essential because it guides what you build – and, crucially, what you don’t. “When I get nervous for them is, when after a couple of minutes, I can’t understand what they’re building,” Matt says.

Identifying a clear purpose and vision becomes all the more important given the rapid evolution of the SaaS industry, whether it’s how fast the underlying cloud technology is changing, the massive transformation of the app economy, or the race to incorporate AI.

Without a strong rudder, you risk your ship running aground. Here’s Matt again:

“Working that message down into something very succinct, very clear, is hard work. It’s actually much easier to use a lot of words to explain what you’re trying to build. But the clearer you can make it, the better. And I think most companies can benefit from having someone who’s not in their space, hearing that story with fresh ears, and giving feedback of whether or not they can understand that.

“Another challenge we see is, particularly in earlier stages, not being specific enough about where they’re going to focus and target. And so some of the first advice I give to a lot of companies is [to] pick one vertical, and then pick one workload within that vertical, and be an expert at that. Be great at that. Prove your use cases. Prove the value that you can generate. Be able to put an economic case to it. Get some great customer stories and case studies. And you’ll get much more traction that way.

“It doesn’t mean you have to pick that one right now and never go work into another vertical. But man, having those first case studies and those first stories is so important. And the only way you’re going to do that is really focusing.”

2. How – and when – to move upmarket

Many SaaS startups are eager to graduate to the enterprise arena. But moving upmarket comes with big risks, and it’s an impulse that can distract from building an essential foundation with small and medium businesses.

Sure, the benefits are attractive: enterprise customers usually translate to rapid growth and a significant bump in profits. But even though they often seem like a silver bullet for revenue, large clients also come with a serious set of demands. As Catherine Pearson points out in a report for Paddle, moving too hastily into the B2B space can bring some major consequences if you haven’t yet established solid footing. It pays to wait for the right moment.

Matt agrees: until you’ve proven your value and can tell your story through clear use cases, it’s best to prioritize the mid-market.

“In some cases, the allure of the big enterprise can be distracting in some ways, that there’s nothing wrong with having a company that’s focused entirely on SMB and mid-market companies. Frankly, they tend to be a lot more profitable customers across the board for all of us. Big enterprises are super demanding. They’re going to squeeze the deal as hard as they can. They have a lot of power in those relationships. And so everyone looks toward them. But it’s the last place you want to start. You’re going to get way more traction, faster, starting lower in the market and then building up to it.

“But the key thing you’re going to need is proven use cases and proven values. So even in those enterprises, they’ll pay attention to a story that’s come from a mid-market account, that you’ve been able to prove the economic value you’ve created for that customer. One of the easy ways you can do it is start tracking your buyers and where they go to. Those mid-market tier companies are prime hunting grounds for next enterprise buyers. And so as you start to see one of your buyers move into one of these bigger enterprise accounts you’ve been trying to get into, that’s a prime way to open a door inside those accounts.

“No one wants to go first. And so particularly in the enterprise space, it’s high risk for them. And so the more proven you are, the better. The more stories you can point to and use cases, the better. And a lot of very well-known brands are actually pretty small companies. And so if you can secure some of those really well-known brands, even if they’re not a big company, that could still have a lot of influence with enterprise buyers.”

3. Navigating AI trends in SaaS

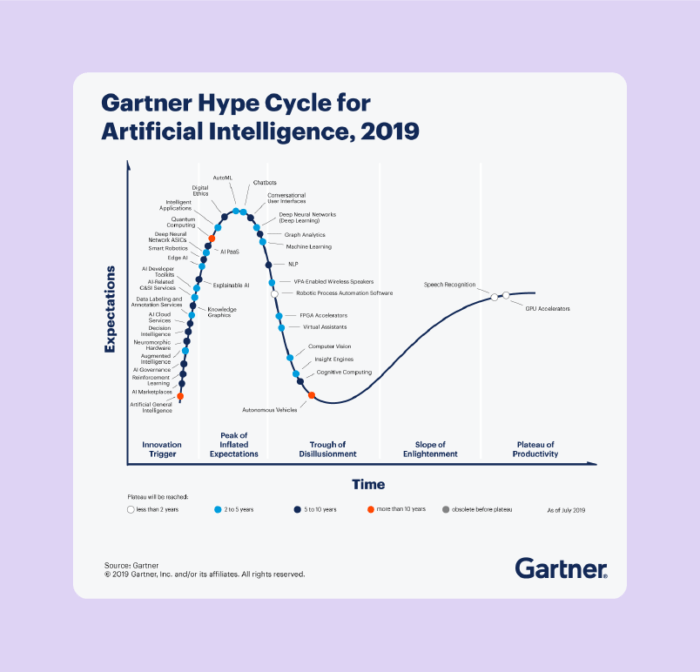

There’s no shortage of SaaS companies claiming to offer AI solutions in the market today but the number that are genuine AI products is significantly lower than the number claiming to be.

One major misstep these companies make is looking at AI as a turnkey solution that will deliver an instant return on investment. In a July 2019 article for the Harvard Business Review, Tim Fountaine, Brian McCarthy and Tamim Saleh make the opposite case: implementing AI successfully requires a broad approach that’s thoughtfully aligned with the company’s structure and culture.

AI is based upon constantly evolving machine-learning models, so it’s important for companies to understand and be able to explain how the data is being handled and processed. Matt says:

“It’s not enough just to optimize a model that spits out the right outcome. The developers who are building those products [are saying], ‘I need to document each step of that model that had a useful output, to explain what the end result was.” And that requires building that way on purpose. [A lot of it] is not using too much data and too many variables. If you can solve a model in a very complex equation with two variables instead of a hundred, it is, in a lot of cases, a lot easier to explain. But that’s really different than the industry was looking at this stuff a couple years ago. A couple of years ago, it was completely fine that the model would spit out the answer, and you’d just accept it. But today, people won’t accept that.”

When asked about ideal AI use cases within SaaS, Matt points to a few examples. At Google, he and his team are using artificial intelligence for the sales and marketing data they collect on customers through support experiences, product deployments and inside the sales pipeline itself. This helps them prioritize accounts that need more attention or those that might be at risk for churn. While it’s an efficient use of Google’s time, it’s even better for the customer because they’re dealing with reps who truly understand their needs and are contacting them at a relevant time about a relevant topic.

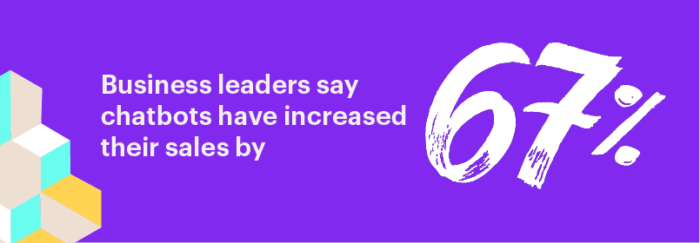

Another great use case? Chatbots.

“Chatbots can be a great way to help a typical inside sales rep have much more interesting conversations during the day. Those chatbots can help you screen a lot upfront that used to [require] a human being have to get through as many contacts as possible before you could have an interesting conversation. It was not a very fulfilling way to spend your day. But if you’ve got these chatbots now that can help screen all that stuff out for you, so that by the time it gets to a person, you’re having a really productive conversation – man, that’s a better experience for our customer.”

But marketing disruptive technology (like AI and chatbots) comes with a lot of landmines.

“One of the most important lessons I’ve had to learn the hard way, and I watch some of my friends in this space going through the same challenge, is going in and talking about the impact, the end impact, the end value that you’re going to drive back for the customer. The technology is really not as important as that end outcome that you’re enabling. What does success look like for them, and how are you going to help them get to it?

“If your product truly is transformative and disruptive, it’s something people haven’t seen before, or it’s going to have a longer adoption cycle, you get so much pressure from investors and stakeholders to go big right up front and go for the biggest enterprise players you can get as fast, as you can, because they do tend to be able to make bigger purchases with you. But they are the slowest to adopt that technology.

“It feels slower, starting down-market and convincing some of those early adopters to gain your product. But that’s the way to do it.”

4. AI advancements to watch for

For decades, we’ve been fantasizing about a world where artificial intelligence is all around us. (Think: service robots, facial recognition, and interactive advertising as imagined in Back to the Future II.)

We had to wait a long time for those innovations to become useful to individual consumers, and now it seems like we’re on the cusp of mass adoption. Think back to when the internet was a place you visited with an AOL disk and a dial-up connection. In 2007, when Apple put smartphones in our pockets, the internet stopped being a destination and became a state of being. We may be on the verge of a similar flip, and the economic implications will be huge – with McKinsey estimating AI’s potential annual impact between $9.5 trillion and $15.4 trillion.

Matt shares this confident outlook:

“The use cases are everywhere. In those initial days of Cloud, you were really focused on people who had servers and how do you migrate servers. But man, AI is going to be used by consumers the way you’re using tools and products at home. You’re going to use it in your doctor’s office. It’s going to be used in manufacturing plants. It’s going to be used by governments.

“And I think we’re just getting started. I mean, when you see some of these use cases today, it’s just incredible what people have built with it. And the technology’s relatively early. So the concept has been around for a very long time, but what’s happened in the hardware space to truly enable the calculations at scale, and what’s happening with the innovation around the neural network capabilities to do all this stuff much, much faster and efficiently, that’s all relatively recent. And the things that are being built on top of that today are just incredible. And we’re early.”

This post is part of Scale, a place where we explore how businesses are driving growth through customer relationships. Scale offers advice and guidance from support, marketing, and sales leaders who are charting new paths for their customers – and their companies.