How Atlassian built a $20 billion company with a unique sales model

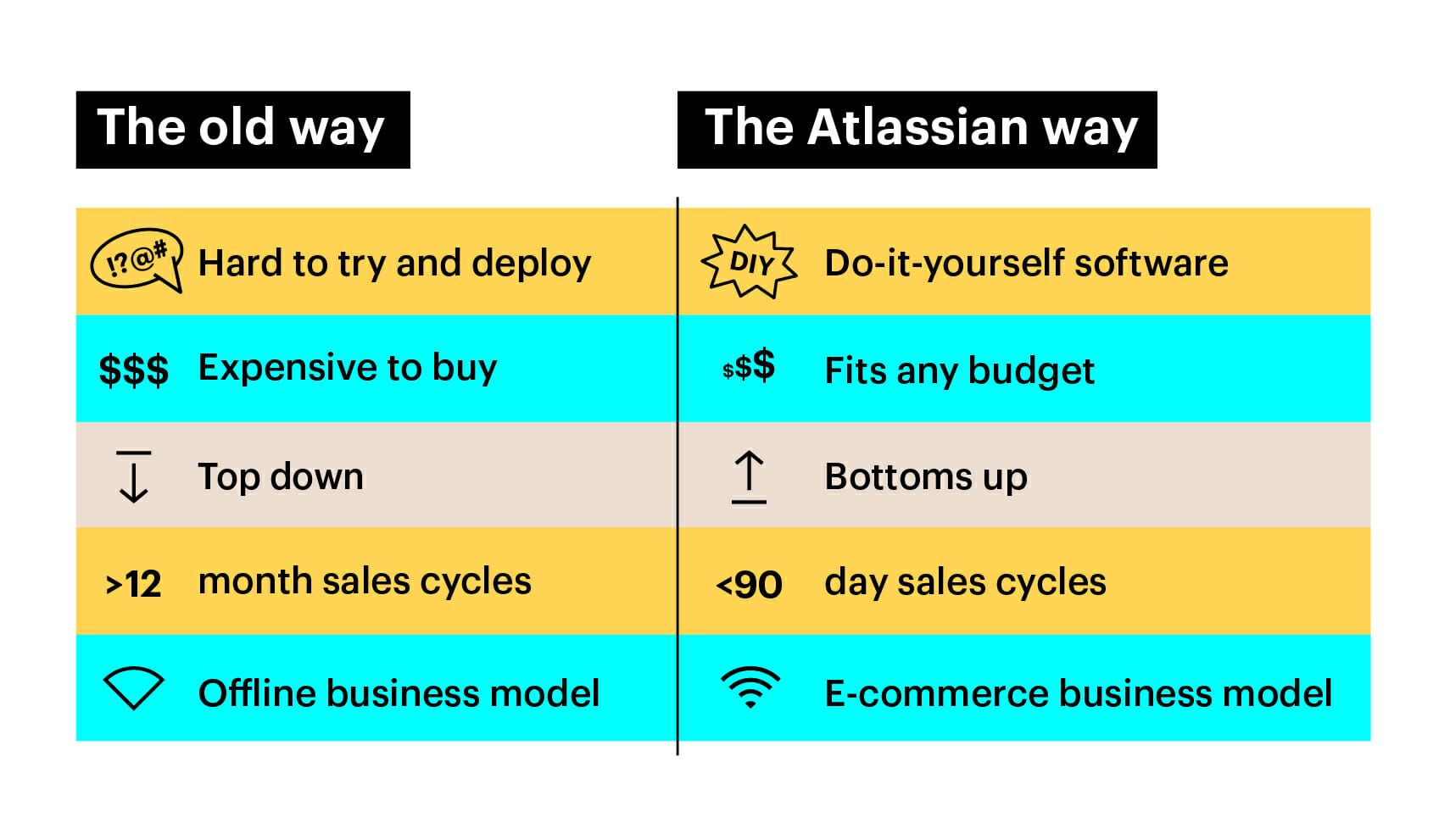

When you think about how “traditional” enterprise-focused firms – think Microsoft, Oracle and IBM – sell software, it usually follows a well trodden formula: negotiations, long sales cycles and a “checklist” of features demanded by decision makers who seldom use the products they buy.

But there is a company that has found a way to scale its software business with an entirely different model: Atlassian. The company behind breakout products like Jira and HipChat and who recently acquired Trello now has more than 125,000 customers, all without any of the formal sales processes above.

This is an unusual feat – almost an outlier – for a growing SaaS company. The typical path to hypergrowth is to invest a huge amount into sales to gain customers in the hope that the lifetime value of those customers will make the initial sign-up costs worthwhile.

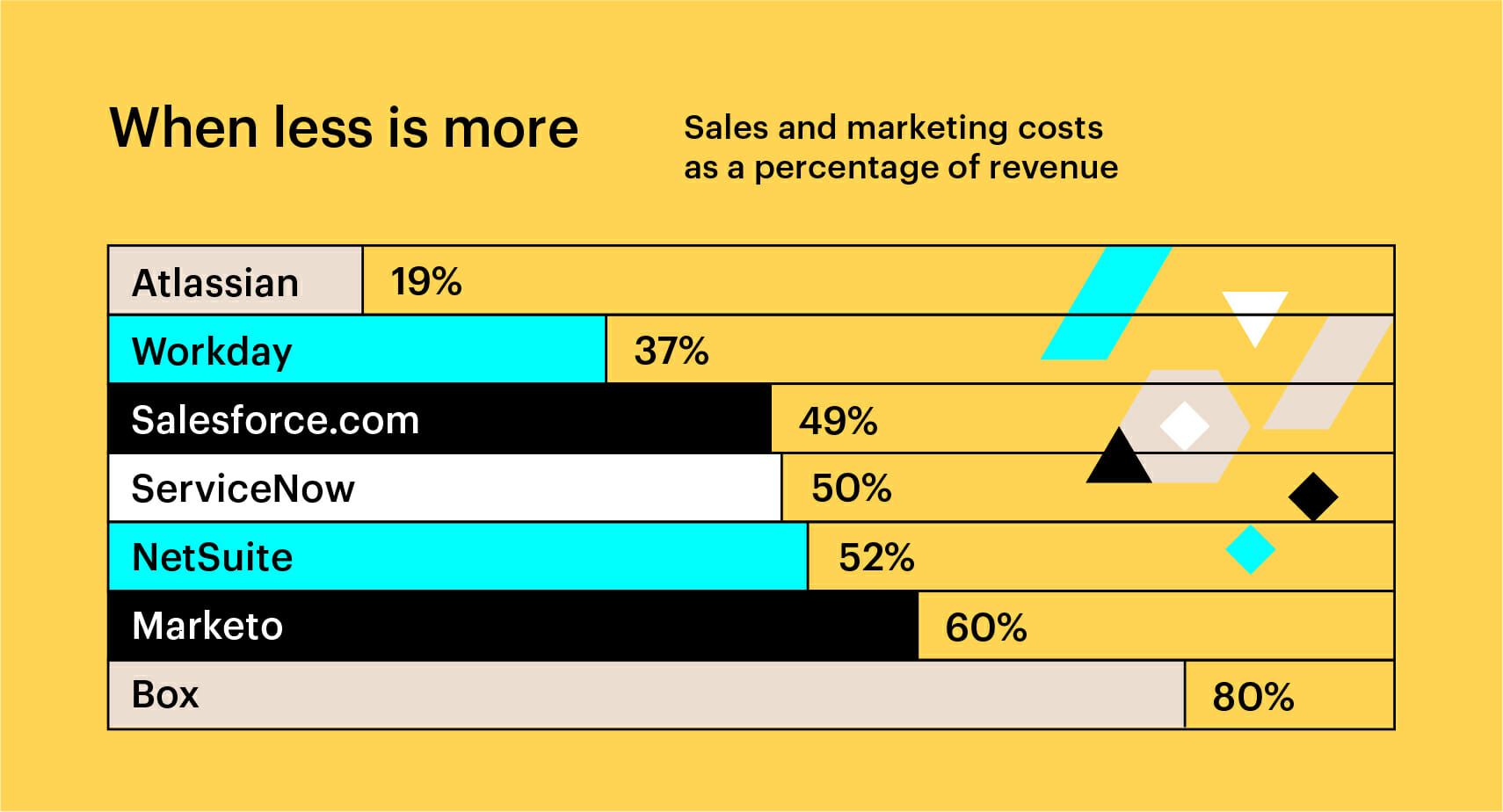

Atlassian, however, forged a different path. At the time of their IPO, only 19% of their revenue was spent on sales and marketing, a fraction of the spend of other companies of their size.

If this all sounds a bit too good to be true, you’d be right. While Atlassian might have eschewed the sales and marketing spend of their peers, they invested heavily into a different distribution model: a high-velocity, bottom-up distribution machine they’ve spent over a decade perfecting.

We sat down with Atlassian’s President, Jay Simons, to get an inside look at how it works. You can listen to our full conversation above, or read Jay’s insights below.

This is episode two of Scale, a brand new podcast series on moving from startup to scale up. If you enjoy the conversation and don’t want to miss the rest of the series, just hit subscribe on iTunes, stream on Spotify, Stitcher, or grab the RSS feed in your player of choice.

It all starts with a remarkable product

The power of word of mouth as a driver of growth is well established.

But what’s less understood is that, to paraphrase Seth Godin, you have to be remarkable to get people to remark about you.

Atlassian’s key early strategic insight was that their products could sell themselves, but only when the key ingredients are in place – a great product, with a passionate userbase who are willing to become advocates for your product both internally and externally. With a tight feedback loop between product, marketing and its end-users, Atlassian was able to create a high-efficiency distribution flywheel to propel its business forward.

Here’s Jay’s take:

“The flywheel begins with creating a great product. Back in the early days of Atlassian, we talked about building a remarkable product. We chose the word ‘remarkable’ with intention. We wanted to build a product that people felt compelled to remark upon. That would then build word of mouth which would help us acquire more customers. But the flywheel begins with a great product that meaningful problems for customers. And then we try to remove as much friction in front of the customer’s path as possible.”

Atlassian’s distribution flywheel

Why the low touch sales model works for the 21st century buyer

The current generation of B2B buyers shop for software in an entirely different way than they did a decade ago. Think about how you buy – you Google it, ask your friends, talk to colleagues. We’ve shifted from a supplier’s world – where supply is limited and the suppliers govern demand – to a world of infinite supply where buyers have all the power.

In this new world, buyers are already armed with lots of information about your product and your company – they might already be playing with a free trial, getting a feel for how your product can solve their pain points. In these situations, the best way to get ahead isn’t to force them to jump on a sales call. It’s to help them get into the product and realize value as quickly as possible.

Jay breaks it down like this:

“The buying cycle for a lot of evaluators and customers has been changing over the past 10 years, with the democratization of information on the internet, and kind of more accessibility. And so I think there was a study, maybe it was an HBR article, that talked about how 65% of the buying cycle is completed by the prospective customer.

So our flywheel has focused on removing as much from the customer’s path as possible. Tell them how much it’s going to cost. Help them answer the most frequently asked questions. And then combine that with incredible service at the other end. And so what we say to a prospect is: ‘We’ve tried to make it as easy as possible for you to discover the capability in this product.”

Low touch sales doesn’t mean no touch

The appeal of Atlassian’s approach for other businesses is obvious. No formal sales teams means lower overheads and more money to divert back into R&D. It almost sounds like magic. You put your product on your website, you drive traffic, and it miraculously, effortlessly sells itself.

But one of the myths of SaaS is that products are so good and so easy to use that the product sells itself. Jay is at pains to point out, low touch does not mean no touch. The low touch sales model might eliminate or minimize the sales team at the beginning of the sales cycle, but Atlassian still have humans on hands to get you up and running.

Jay explains it like this:

“If you’re a large enterprise customer that has more complexity, or potentially more value to us, we have a team that can help steer you in the right direction and answer a more complicated set of questions that you have. We call them enterprise advocates and it’s something that we began to grow about four years ago, with a focus on really complex large customers.

But the question is, if we add 5,000 new customers a quarter, and add that to the base of 120,000 existing customers, it would be very, very difficult to do that if we had to touch of all of those customers along the way. It meant that we had to focus on building efficiency in the flywheel model, where most customers, if they wanted to go all the way through signup and straight into the product, they could. If they don’t need us, that’s great. We’ll leave you alone. If you do need us, then we’ll absolutely bend over backwards to help.”

The benefits of a transparent pricing model

Look at B2B software websites and note how many of them actually put pricing numbers online. Not many. Why give your competitor a chance to potentially undercut you or your customer a chance to pay less than what they would have offered for your product?

In this world, Atlassian stand out as an anomaly. Their goal with their pricing is to get out of the customer’s way, to make it as easy as possible to get up and running with their software, without hassle or drawn-out sales processes. Point, click, buy and use.

As Jay explains:

“A really common friction point that people insert is cost. I’m not going to share with you how much the products costs on our website, or you have to contact us to find out. The psychology is: ‘I don’t want to scare the customer away, potentially with a higher price point, before I can explain to them what this could really do, and understand their problems and try to persuade them that it’s going to be worth that ultimate cost.’

In our model, we’ve focused on removing price as a potential point of friction, even at the upper end, which in turn aids velocity. It means that even an enterprise customer could come to the website, spend $10,000, start with a team of 10 or team of 50 and get going without actually needing to talk to us.”

The low touch sales model isn’t for everyone

Choosing the right go-to-market sales model for your startup can be a make it or break it decision. Choosing the wrong one could leave you dead before you even start building anything at all. The challenge with choosing the right model comes from the fact that it’s not only about changing a pricing page, adding features, choosing a specific marketing tactic or hiring salespeople. It’s about taking into consideration all the components of your business.

As Jay puts it:

“Your business model is factored around your market, and how you want to reach that market. If I were Workday, for example, and I see my market as the 2,000 biggest companies on the planet, I don’t think Atlassian’s models are appropriate for that. Buying Workday is a single, largely top down decision, insofar as you’re not going to pick multiple human resource management systems. You’re going to pick one, and it’s going to be sponsored by the head of HR and probably the CIO. That is a top down, consultative and likely long sales cycle. That’s not a try, buy, begin and expand model.

As a founder of a company, you need to think about all those things. My word of caution is this: you can’t look at Atlassian and say, ‘I’m going to do it the way they did,’ because I think there were many things that enabled us to build the model in the way that we did.”

Jay’s advice is clear: regardless of whether you’re selling a SaaS service or a physical good, you first need to understand who your target customer is and what it takes to attract them. It’s only then that you can figure out if the low touch sales model is for you.

This post is part of Scale, a place where we explore how businesses are driving growth through customer relationships. Scale offers advice and guidance from support, marketing, and sales leaders who are charting new paths for their customers – and their companies.