All that glitters is not gold: Angel investor Christoph Janz on finding the right opportunities in AI

Last year’s developments in generative AI opened up a world of possibilities for SaaS startups and established companies alike. But is every opportunity worth pursuing?

It may not seem like it, but we’re approaching the one-year mark since the groundbreaking launch of ChatGPT. It was just last November that any skepticism about its capabilities was replaced by a wave of restlessness and excitement that set the stage for a year of reflections, learnings, and exploration. It’s fair to say we were all caught off guard to see how well it performed – and today’s guest, Christoph Janz, is no exception.

If you’re part of the European SaaS tech ecosystem, chances are you know him already. Christoph is, as he puts it, an “internet entrepreneur turned angel investor turned micro VC.” For over 15 years, he’s been advising and investing in companies like Zendesk, Clio, Momox, and Geckoboard, and in 2011, he co-founded Point Nine Capital, an early-stage venture capital firm focused on SaaS, enterprise software, and B2B marketplaces, where he holds the position of Managing Partner.

In the past year, he’s delved into the realm of generative AI and Large Language Models to better understand their impact on the world of B2B SaaS, and how they would transform the playbooks on building, funding, and scaling SaaS businesses. Where are startups better suited to challenge established players? Can they transform mature categories with an AI-first lens? How do these risks play out in horizontal and vertical markets?

In today’s episode, Christoph talks to our Co-founder and Chief Strategy Officer Des Traynor about the implications of generative AI for SaaS companies and early-stage SaaS investors, and where those golden opportunities lie.

Here are some of the key takeaways:

- In broad, mature markets, established companies have a strategic advantage in leveraging AI, as startups must build not just the AI but an entire, significantly better ecosystem.

- As co-pilots and auto-pilots gain popularity, the downstream effects will transform not just pricing but also UI, brand identity, and differentiation.

- Verticals, new categories of previously unsolvable problems, and hard tech areas are a strategic bet for startups – the specificity of a use case reduces the likelihood of big players entering it.

- Vertical markets may have market size limitations, but startups have a more direct path to customers, making it easier to secure higher market shares and sustained growth.

- Due to the sometimes prohibitive costs of operating with GPT-4, companies may potentially accept lower gross or even negative margins to secure a foothold in the market.

If you enjoy our discussion, check out more episodes of our podcast. You can follow on Apple Podcasts, Spotify, YouTube or grab the RSS feed in your player of choice. What follows is a lightly edited transcript of the episode.

A wake-up call

Des Traynor: Hi, and welcome to Inside Intercom. Today, I’m delighted to be joined by a friend and one of Europe’s most prominent investors, Christoph Janz, from Point Nine Capital. Hi Christoph, how are you doing?

Christoph Janz: Hi, Des. Very good. How are you doing?

Des: Yeah, pretty good. Whenever I see you, I’m always reminded that you wrote the first check to our archrivals at Zendesk, and that’s one of the sort of funnier stories of which I first heard of you. You have been doing a lot less help desks and a lot more AI over the last while, is that right?

“I was taken by surprise seeing how well ChatGPT performs, and I think even people much deeper into AI have also been surprised”

Christoph: Yeah, or maybe the intersection of the two, right? Probably a good topic for us to chat about since the customer support industry has a special place in your heart and in my heart, as well. It’s what got me into SaaS in 2008.

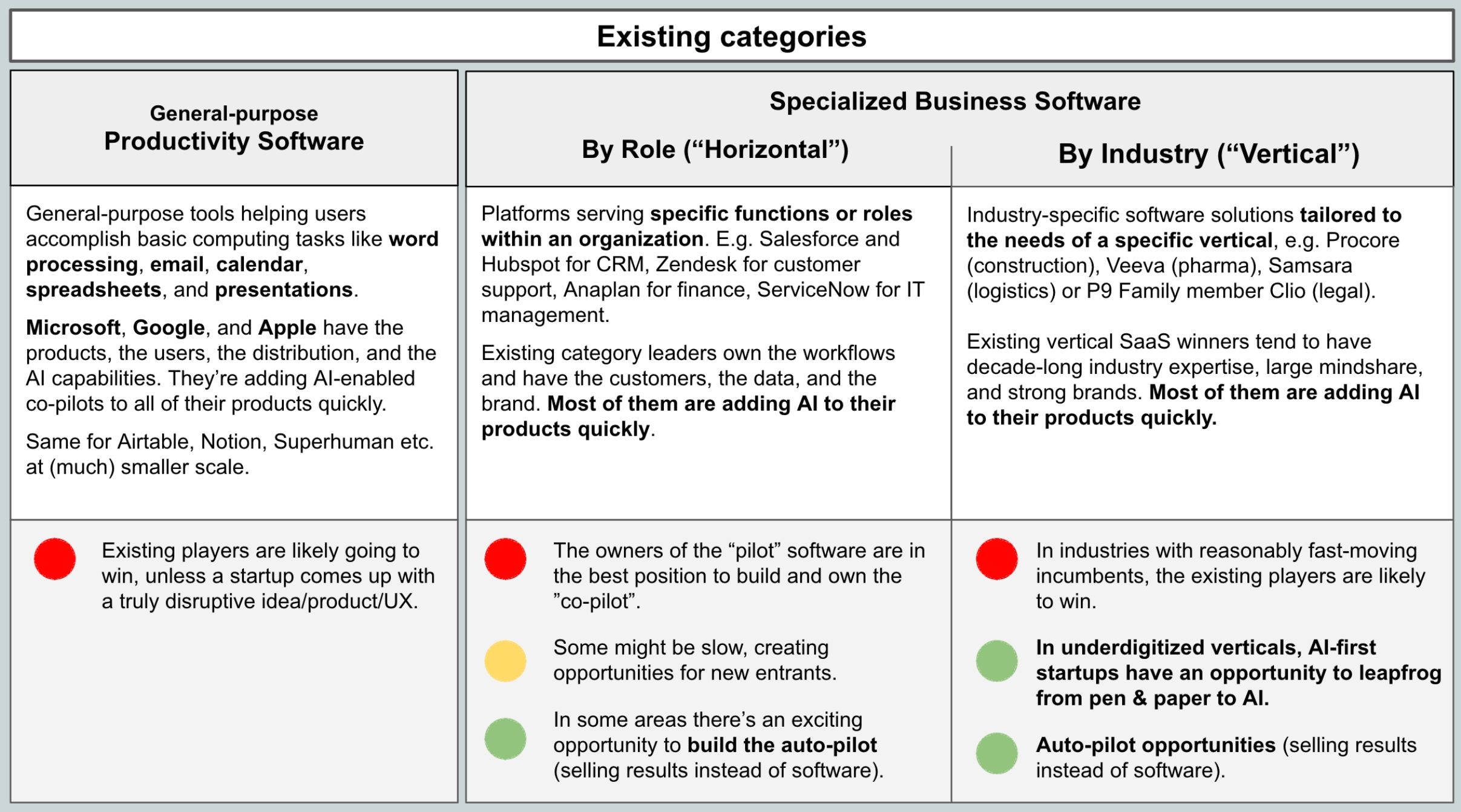

Des: Yeah. Probably the biggest thing I want to talk to you about is where are the opportunities in AI? If you’re thinking about entering customer support, is it a rich area for an entrant, or is it an area where the incumbents have all the power? That’s probably the most interesting area to chat about. You have a post on Medium, and the gist of it was kind of a mental map of how you think about the opportunities.

Say it’s November 30th of last year, ChatGPT has just dropped, and everyone’s realizing that generative AI is here and it’s not fucking around. How quickly did you react from an investment perspective? Was it obvious to you immediately, that there were going to be a lot of areas upended, and you needed to reconsider all of your investment ideas? Or were you a slow believer?

Christoph: For me, personally, it’s been a huge aha moment; a wake-up call or, to some extent, maybe an existential crisis or a rollercoaster ride thinking about the opportunities and threats. Obviously, ChatGPT has been a success – the typical overnight success many years or even decades in the making if you look back at what it’s based on in terms of prior AI research. Nevertheless, I was taken by surprise seeing how well ChatGPT performs, and I think even people who have been much deeper into AI have also been surprised. I actually feel a bit embarrassed that I was so surprised.

Des: Anywhere you see grounds for a threat, you’ll probably, as an investor, see grounds for an investment, and vice versa. If incumbents are pretty well defended, you’re probably not going to go and fund. Our audience is primarily startup founders and folks who work in product and the like. What’s an example of an obvious “This isn’t going to work,” as in, like, “Hey, all the power is with the incumbent. We should not write a check here.” What’s the worst-case pitch you’d get?

“It’s probably an area where you need a 10x better and cheaper product. 50% better is not good enough to win against Excel or Google Sheets”

Christoph: I’m happy to answer that and mention some areas where I’m pretty skeptical, but I’ll also say that there will always be exceptions. We never have absolute knowledge of anything, and there will always be founders who prove things wrong. And that’s amazing.

Now, I don’t want to discourage anybody, but I would say, in those areas that are very broad and horizontal, such as word processing, spreadsheets, note-taking, to-do lists, calendars – basically the classical Microsoft Office package, which is now also like the G Suite – it’s very hard to compete for relatively obvious reasons. Everybody uses these apps already, and they are either free or perceived as free because you get them as part of some bundling. I think there will be opportunities to win, and maybe Notion or Airable are examples. Based on that framework, those companies shouldn’t exist, but they do. So, there are always founders who bend reality, but it’s probably an area where you need a 10x better and cheaper product. 50% better is not good enough to win against Excel or Google Sheets. It needs to be very, very different in some vectors.

“A strong SaaS company, like Intercom, that’s maybe 10 to 15 years old, is in a great position to leverage AI if it’s still able to move fast enough”

Des: It seems like there are two barriers there. First, it’s hard to compete with these things because it’s going up against a pretty fully-featured and effectively free product, so a sprinkling of AI or even a lot of AI might not be enough to overcome the $0 price tag. Are there other areas where you think the market is there, but…? If we move away from areas where the suite or the packaging is a barrier, are there other areas where the future of something like expense tracking or the future of Workday or tools like that is still pretty impenetrable for other reasons?

Christoph: I have a medium-strong, weakly-held opinion on this. I’m always happy to learn and be convinced of the opposite, but I tend to think that in those areas where you have a strong SaaS company, like Intercom in case of support, or Factorial and Persona in HR, that’s maybe 10 to 15 years old, is in a great position to leverage AI if it’s still able to move fast enough, which is probably not true for every company, but it is true for some. You spoke about how you led these efforts at Intercom. Intercom is, I think, a role model for a company that’s already at a sizable scale but still moving really fast. And it’s not so clear how a startup can find an angle of attack in these markets.

Des: I think oftentimes, the challenge folks overlook is it’s not that it’s impossible to find a way in which AI is really cool, and it could be really powerful AI – it’s that you still have to go and build out everything else. If you like to look at Intercom and say, “Right, you know what, they’re not AI-ing hard enough; we can do more AI than them.” If you really want to rob a customer from us, you still have to go and build a ticketing solution – voice solution, inbox, live chat, messenger, knowledge base articles, you name it. You have to do all that shit and do your AI on top. And I think there are other areas where it’s more attackable because the AI actually forms the majority of the new product you would build.

The era of self-running products

Des: Sticking in the existing business area – what about this idea of we’re going to build a co-pilot-type solution for everything?

Christoph: Yeah. I think this has pretty quickly become a pretty obvious idea, popularized by GitHub’s Copilot which, as far as I know, was the first one to have this label, and very quickly, you had co-pilots for everything. I think the concept makes sense in so far as I do believe there will be some kind of co-pilot or even auto-pilot, which we can talk about as well, for every software, but it doesn’t mean it’s an opportunity for a new company to disrupt the existing players for some of the reasons you’ve mentioned. And to your point, on all the things that you have to rebuild, if you keep that in mind, maybe this idea of an auto-pilot is more promising. You’re not even trying to replace something like Intercom – you come in and tell the customer they don’t have to adapt to any new software. What you get from them is a virtual team member like a customer support agent, a sales agent, an SDR, or a financial analyst who is being onboarded and trained to your existing systems. It’s quite similar to how you would onboard and train a human employee. And that virtual team member will then take over a certain part of the job.

“I feel like the next wave of innovation will be this idea of products that effectively run themselves. Your job is to train the bot, and the bot does the work”

I think that is a really fresh proposition. But it’s still early on to tell how or in which markets this is going to work because, until recently, this wouldn’t have been possible. At least not if you wanted to be a high-margin business and didn’t want to do it manually.

Des: I totally agree with you. I think everyone’s been studying this space pretty closely. I could totally imagine an auto-pilot that literally sits inside an Expensify and approves or rejects expenses based on everything it knows about the expense policy and everything it knows about the Expensify UI or something like that. That makes total sense.

I haven’t seen it yet, but I feel like the next wave of innovation will be this idea of products that effectively run themselves. Your job is to train the bot, and the bot does the work. What’s interesting to me is there are all sorts of downstream implications around everything from brand and differentiation to pricing. The pricing thing’s obvious – it’s a big change when you’ve got one mega bot doing all the work. But the brand and differentiation are interesting as well. If no one’s logged into these products, what is the product? It’s almost like mid-ware or background service running. It’s no longer a thing. You’re actively diminishing the role of the software in the company’s life, if you know what I mean.

All of a sudden, you don’t care who you’re using for expense tracking. You just send an email and look away, and it’s all done. But when something is so isolated and still performing well, you would happily just plug and play. Honestly, it’s hard to see that not becoming a race to the bottom because there’s no advantage to having a beautiful UI. It’s not obvious to me. In a world where increasingly large amounts of product workflows are handed over to auto-pilots, mega bots, or whatever you want to call them, how will customers go shopping? Will it just be a pure utilitarian “Who is doing the job best?” and that’s who they’ll pick?

“In many cases, businesses don’t use and buy the software because they are thrilled to buy another software and to train their employees how to use it. They need it to achieve a certain result”

Christoph: There is this funny quote from an economics professor at Harvard or something who said something like: People don’t want a quarter-inch drill – they want a quarter-inch hole in their wall.

Des: Professor Theodore Levitt, if you’re curious.

Christoph: Thank you, thank you. I think it probably applies pretty well to software. With some exceptions in some areas, such as creative tools and so on, in many cases, businesses don’t use and buy the software because they are thrilled to buy another software and to train their employees how to use it. They need it to achieve a certain result. If that’s money in the bank, and they don’t have to use an invoicing software for that, they’ll probably be quite open to it. Or they could probably imagine not using the software their SDRs use for their email campaigns if they just get deletes, which is what they want. I think this is a promising strategy for new entrants. But I think you make some really great points. If you try to think this to the next level or to the end, it’s really hard to say.

Des: Yeah, exactly. And if you extrapolate from the patterns we’ve seen, it’s quite possible a lot of pretty visible products will end up headless. And then, what will be the primary software products of a company in 10 years’ time?

Uncharted territories

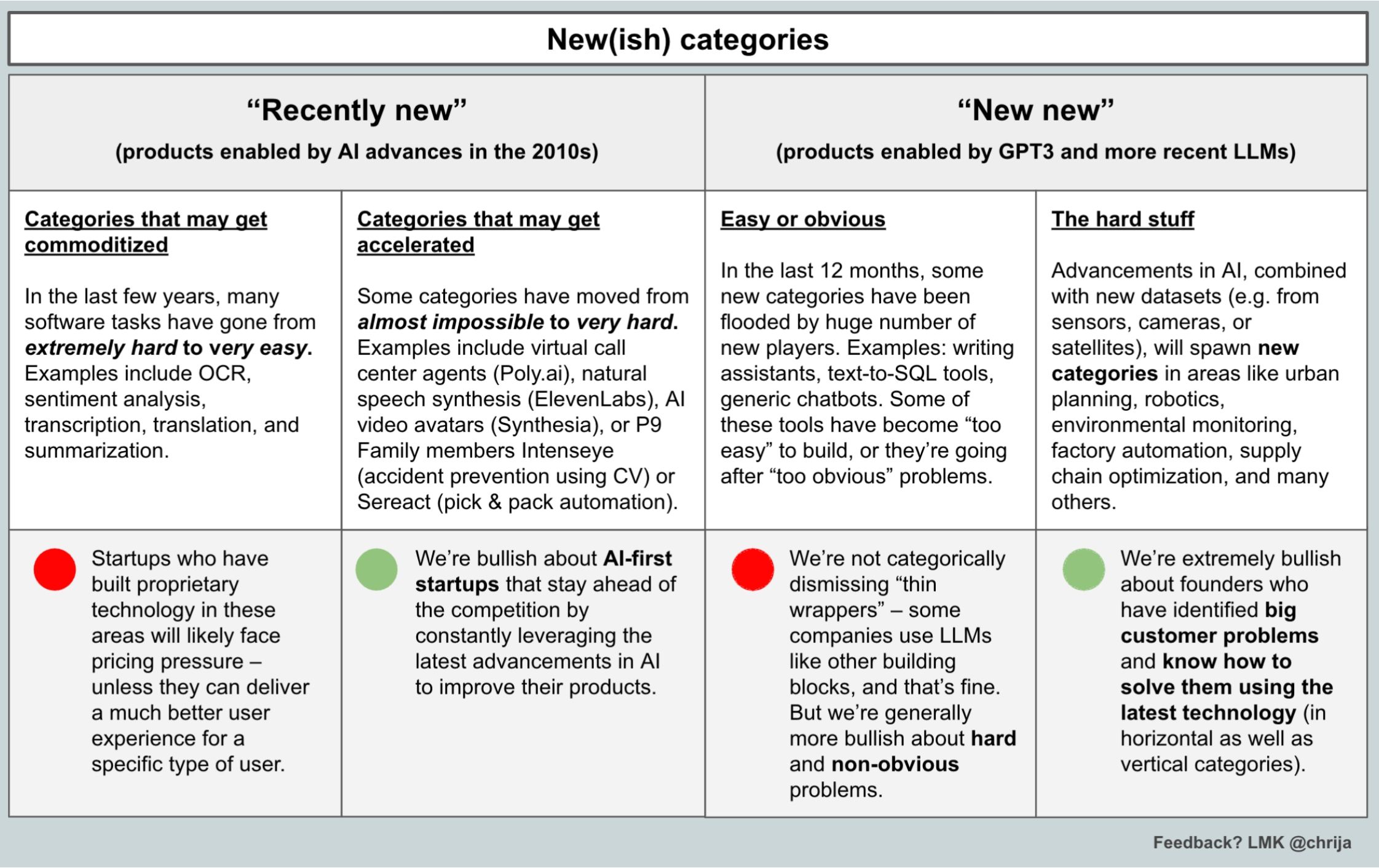

Des: If we change direction for a little bit, along with displacing and reinventing all the current classic tooling of our world, there are also brand-new categories. There’s new stuff that is possible now that wasn’t possible before. And you have some ideas about what these are. My mind goes to the entire DALL·E space, virtual videos that can be created, and endless stories that can be animated. This literally wasn’t possible before. What do you think about the brand-new capabilities out there? Which will be features, and which will actually be products?

Christoph: I think this is actually the most interesting place to build new companies because, well, you don’t have an incumbent that you have to displace, and you leverage new technologies to solve big problems in a way that wasn’t possible until recently. What can be better than this for a startup, right?

Des: Out of curiosity, do you have an example of one you’re happy to speak about? I’m looking for examples to help people understand the difference between Slack + AI versus Synthesia, right? Where it’s like, “Hey, generate AI-paired videos based on this small video input.” That literally wasn’t possible four years ago.

Those are really fascinating use cases, and it’s also just really hard. It’s not only hard from an AI perspective but also from a systems integration and sales perspective.

Christoph: I think Synthesia is a great example, and another one in the generative image creation space in our portfolio is a company called Mokker AI, which creates virtual product photography. And interestingly, they started a couple of years ago with a 3D model-based approach. They simplified 3D CAD modeling and turned it into a virtual photo studio that worked reasonably well, but it was still a bit too hard to create the scene, place the object, and get the virtual lights and everything, despite the fact that they made it much, much easier compared to sophisticated 3D modeling software. And then, about a year ago, they started to play around with some of the image generation models. Initially, they were still a bit skeptical. Would the quality be good enough? But through iterations over a couple of months, they improved it so drastically that the quality of the photos is now basically indistinguishable from real photos, and that’s something that wasn’t possible before. It allows product marketers or people in online shops to create huge variations of an existing image, which is obviously great for A/B testing and all kinds of other things.

Another example would be a company called Sereact, which we invested in quite recently. It uses computer vision to power the pick-and-pack robotic arms. They’ve been doing ML research for many years, but they are now using LLMs to build something they call PickGPT, where you give a conversational command, and the model translates that into an instruction for the robotic arm. Those are really fascinating use cases, and it’s also just really hard. It’s not only hard from an AI perspective but also from a systems integration and sales perspective.

Des: That’s what I was going to say. What I love about that is that I believe it might be possible, but more importantly, I believe no one’s going to be like, “We should do that.” I’m always terrified of clever ideas that are definitely doable, because all they need to do is go viral on Hacker News, and all of a sudden, you’ve got 27 copies of that idea, each with its own little variation. No one’s going to be like, “I might try and control a robotic arm – I have one of those on the shelf over here.” At least, your competitive set’s so much smaller. Are you more excited by new product areas enabled by AI, or applying AI to existing areas?

Christoph: New areas. It’s not black and white, but to answer your question directly, if you ask me this as a binary question, I go with new areas.

Des: Verticals or horizontals?

Christoph: Verticals.

Des: Lastly, hard or easy?

Christoph: Hard.

Des: Yeah. It’s interesting, and maybe your robotics example is a great piece there, but I would argue the product Mokker is probably also similar. It’s arguable that some of the biggest winners here will be on the existing software when the AI is accessible, and it’s obvious what you should do with it. So, in customer support, you would say it’s obvious that people are going to build generative chatbots to answer questions. The hard part is having a complete solution that lets humans and AI work side by side together and making sure you actually fit within the support team, and you’re not just some external cludge wedged into the stack.

“When you go into verticals, inherently, you’re going to bump into less competition. When you go into hard tech, you’re going to bump into less competition. And if you’re building a new type of thing, the work you’re displacing isn’t a software product”

But I think, in general, in well-established existing categories that have active incumbents who are reading the right tech blogs and following the industry, it’s hard to imagine too many of those companies dying unless they have some sort of religious opposition to AI. Whereas in the other areas you described, say, when you go into verticals, inherently, you’re going to bump into less competition. When you go into hard tech, you’re going to bump into less competition. And if you’re building a new type of thing, the work you’re displacing isn’t a software product. It might be a team of photographers or humans who lift stuff in warehouses, but it’s rarely going to be like, “We have to cancel our subscription to such-and-such and turn on our subscription to Mokker.” So, I think that’s an interesting thesis.

If I were to ask you about companies you wished you had invested in over the last year in this generative AI space, there have obviously been some pretty hot ones. Are there ones where you’re like, “I wasn’t even in the deal and didn’t hear about it until it was done, but man, it looks like a monster company”? What are your favorites in that regard?

Christoph: Probably ElevenLabs, the voice generation, voice-cloning company, which we saw a bit too late, when they had so much traction they raised a large round. They were too quickly out of the Point Nine sweet spot. People still have different opinions about this company and tech, and if this will get commoditized. OpenAI is working on this and many others, so obviously, the jury is still out. But it’s an extremely impressive team – very small – who built probably the world’s best text-to-speech engine. And I think if they keep pushing it as they did in the past, they have a chance to win something really big despite the fact it looks like a battle against all odds in a category where all the big players have their stakes and are investing large amounts of money.

Navigating market risks

Des: What do you think about what we would call the platform risk? The idea that, actually, the next version of GPT-5 and the next round of ChatGPT will include “speak into the microphone for 60 seconds, and we’ll clone your voice.” That’s obviously, at the very least, a low-end risk for the casual consumer. When you’re looking at opportunities, how do you think about what’s going to get absorbed either into OpenAI or ChatGPT? Or maybe, in the future, when we get there, into operating systems, as in, iOS will do that natively, and you don’t need a custom app to do it? How do you assess platform risk?

“The more specific or obscure the use case that a company solves is, the less likely it is that it’ll be part of the next release of ChatGPT”

Christoph: I think it goes back to the points you made about hard problems, in either verticals or very specific horizontal use cases. I think the more specific or obscure the use case that a company solves is, the less likely it is that it’ll be part of the next release of ChatGPT. I don’t know when this show will air, but it’s been a very interesting weekend, so the future of the company OpenAI is maybe a bit less clear than it was two or three days ago.

Des: Just for our listeners, we’re recording this on Tuesday, the 21st of November, so that everyone knows the context of what we’re talking about. But yes, I’m less certain that OpenAI is going to dominate the world right now than I was seven days ago.

Christoph: Yeah, exactly. Same here. Nevertheless, whether it’s going to be OpenAI, Microsoft plus Sam Altman, or something from Google or Facebook, there will be very impressive products from the big players, and they will target the end consumer but also businesses including enterprises. So, for example, the use case of ChatGPT for my company data. I am a massive believer in this. I think every company wants this. I am sure there is a huge pull. It solves this decade-old knowledge issue. But I’m not sure if it’s specific enough to be an amazing startup opportunity because my guess is that in one of the next versions of OpenAI, they will do this.

Des: Exactly. Or the G Suite will just include it somewhere, and the G Suite has access to literally everything. The idea of you building all of those things, or building an API into the Google Drive that has advantages over Google just seems really, really hard to penetrate. We’re running the risk of saying verticals are the best place to go. What’s hard about verticals?

“There is a chance that, ultimately, a company like Cleo will own maybe 40% of the market as opposed to maybe 2% or 3% it would get in a horizontal market”

Christoph: Even if we forget about AI for a minute, what people have generally not liked about vertical SaaS, which made it, at times, difficult for us to raise follow-on financing for our vertical SaaS companies, is that the market size is somewhat limited.

We invested in a company called Cleo in 2009. It’s legal practice management, and it allows small law firms to run their entire practice. For some time, it was thought that the market was not big enough because you can count the number of lawyers in the US or the industrial world and multiply that by what they might be willing to pay, and you probably get to billions, but not hundreds of billions.

In many cases or for many markets, those investors have been proven wrong for a couple of reasons. One, those companies have a chance to get much, much higher market share, so there is a chance that, ultimately, a company like Cleo will own maybe 40% of the market as opposed to maybe 2% or 3% it would get in a horizontal market.

“Going vertical is what you trade off in the total market size because it’s not like the hundreds of billion-dollar market that a VC might want to hear in order to justify the check”

Some of these companies have also managed to continuously increase the ARPA, the average revenue per account, by just doing more and more for their customers over time, which is a bit against the conventional wisdom of focusing on something. I think focus is important initially, but then-

Des: You can grow it out, right? You can expand. You’re like, “Hey, let’s solve more problems now that we have the customer base.” That makes sense. I think going vertical is what you trade off in the total market size because it’s not like the hundreds of billion-dollar market that a VC might want to hear in order to justify the check. You trade the massive market for a more direct line to these customers. If you need to reach dentists, that’s a lot harder than reaching SMBs, 5-25 people. Dentists all go to dentistry conferences and read dentistry blogs, you know? It’s a very attackable market.

Secondly, you’re almost always not bumping into, for lack of a better word, the cool kids of Silicon Valley. Every YC incubator is not going to spin up 25 more businesses going after the dentistry area. But I guarantee it will spin up 25 more AI for image generation startups. It’s almost like if you’re willing to dial down your ambition, you can dial up your expectations of hitting the ambition because you’re probably going into an open market where they’re all ready to pull the product off you.

Christoph: Those are some of the reasons why we really love these vertical markets. The companies we know usually don’t double year-over-year for many years. They tend to grow a bit slower because the market is not infinite in terms of size or maybe because some of the verticals are lagging behind in terms of tech adoption. But we’ve seen that some of them have an amazing persistence. They just keep growing 30%, 40%, 50% year-over-year. If you do this for 15 years and never stop, you end up with a pretty sizeable business aswell.

Crunching the numbers

Des: My last question on tactics of investing. Are the check sizes different in a world of generative AI? Are your concerns around margin different? Knowing that a lot of money is going to go straight through the startup over to Anthropic or OpenAI and that the margins you might have been used to, like the 80% or 85% SaaS margins, might not be the case if every single customer interaction is a roundtrip to a server through some pretty expensive GPT-4 calls.

Christoph: This is definitely a topic for some of the companies I’m working with. Sometimes, they are able to build a feature in testing or beta that works really well but only with GPT-4, which, in some cases, it’s just too expensive. Then, one possibility but also a challenge, maybe you can make it work with GPT-3.5, which is much, much harder, and the quality’s not as good out of the box.

“Maybe you’re willing to accept lower gross margins or even negative gross margins if you have the funding and want to claim your space”

Des: In a lot of cases, I see startups just crossing their fingers and just being like, “It will get cheaper.” That might be a valid strategy, you know?

Christoph: I think that’s actually a pretty good bet to make. You have to think about timing, and maybe you’re willing to accept lower gross margins or even negative gross margins if you have the funding and want to claim your space as long as it can become a reliable business based on certain assumptions for cost reductions. Because I think the costs are going to get down, right?

Des: On check size, are you happy enough to accept that these businesses need more money and, therefore, for it to be viable, we have to give them more? Maybe that changes ownership percentage, or maybe it doesn’t, but you’re aware that $2 million into a generative AI startup isn’t as big as it sounds these days.

Christoph: With the companies we’ve invested in, with one exception, none plan to spend millions or tens of millions on computing. Most companies we invested in are not at the foundational level-

Des: They’re not training models or anything.

Christoph: Yeah. They do some training but not as high intensity.

“We’re looking at interesting companies right now, and I think we will continue to see interesting companies in the next months and year”

Des: Christoph, thank you so much for your conversation. We’ll link up all the details in the show notes, including your mental model for investing in AI. Really enjoyed your conversation. Thanks so much.

Christoph: Thank you so much, Des. I enjoyed it as well.